This ending retained earnings balance is transferred to the balance sheet. The income summary account is an intermediate point at which revenue and expense totals are accumulated before the resulting profit or loss passes through to the retained earnings account. However, it can provide a useful audit trail, showing how these aggregate amounts were passed through to retained earnings. The company can make the income summary journal entry for the revenue by debiting the revenue account and crediting the income summary account. Both revenues and expenses are designated/classified as operating and non-operating. Reconciliation is an accounting process that compares two sets of records to check that figures are correct, and can be used for personal or business reconciliations.

The income statement reflects your net income for the month of December. This entry zeros out dividends and reduces retained earnings by total dividends paid. Concepts Statements give the Financial Accounting Standards Board (FASB) a guide to creating accounting principles and consider the limitations of financial statement reporting.

How do you calculate income summary?

Permanent accounts are not closed at the end of the accounting year; their balances are automatically carried forward to the next accounting year. Since cash was paid out, the asset account Cash is credited and another account needs to be debited. Because the rent payment will be used up in the current period (the month of June) it is considered to be an expense, and income summary normal balance Rent Expense is debited. If the payment was made on June 1 for a future month (for example, July) the debit would go to the asset account Prepaid Rent. The revenues a company earns from selling the products are usually credit in accounts payables on the normal balance. This usually happens for the retailers, who sell the things they receive on credit to the consumer.

To gain a better understanding of what these temporary accounts are, take a look at the following example. It can also be called the revenue and expense summary since it compiles the revenue and expenses that stem from the operating and non-operating business functions. Revenues and gains are recorded in accounts such as Sales, Service Revenues, Interest Revenues (or Interest Income), and Gain on Sale of Assets. These accounts normally have credit balances that are increased with a credit entry. Because you paid dividends, you will need to reduce your retained earnings account, which is what this entry accomplishes.

Recording Adjusting And Closing Entries For A Partnership Ppt Video Online Download

Treat the income statement and balance sheet columns like a double-entry accounting system, where if you have a debit on the income statement side, you must have a credit equaling the same amount on the credit side. In this case we added a debit of $4,665 to the income statement column. Once we add the $4,665 to the credit side of the balance sheet column, the two columns equal $30,140. Next you will take all of the figures in the adjusted trial balance columns and carry them over to either the income statement columns or the balance sheet columns. Total expenses are subtracted from total revenues to get a net income of $4,665.

- US GAAP has no requirement for reporting prior periods, but the SEC requires that companies present one prior period for the Balance Sheet and three prior periods for the Income Statement.

- As a corresponding entry, you will credit the income summary account, which we mentioned earlier.

- For this reason the account balance for items on the left hand side of the equation is normally a debit and the account balance for items on the right side of the equation is normally a credit.

- For accounts receivables that are on the assets side, the normal balance is usually debit.

- Since the income statement shows financial activity over a given fiscal period, internal management and external users can use this information to compare one fiscal period to the next.

- At the same time, the company has also gain assets worth one thousand dollars.

As the first step, the revenue accounts have to be closed, wherein such balances would reflect credit balance at the end of the financial period. The revenue accounts would be closed by giving the credit summary on to the income summary. A debit would be done to the revenue account, and the credit would be done to the income summary account. Once all the entries are passed, all the values in the revenue account would amount to zero. The income summary account is defined as the account of temporary or provisional in nature wherein the statement at the end of the accounting period net off all the closing entries of expenses and revenue accounts. Your closing journal entries serve as a way to zero out temporary accounts such as revenue and expenses, ensuring that you begin each new accounting period properly.

Normal account balance definition

As a corresponding entry, you will credit the income summary account, which we mentioned earlier. If you look in the balance sheet columns, we do have the new, up-to-date retained earnings, but it is spread out through two numbers. If you combine these two individual numbers ($4,665 – $100), you will have your updated retained earnings balance of $4,565, as seen on the statement of retained earnings. Unearned revenue had a credit balance of $4,000 in the trial balance column, and a debit adjustment of $600 in the adjustment column. Remember that adding debits and credits is like adding positive and negative numbers. This means the $600 debit is subtracted from the $4,000 credit to get a credit balance of $3,400 that is translated to the adjusted trial balance column.

- Using a 10-column worksheet is an optional step companies may use in their accounting process.

- The five column sets are the trial balance, adjustments, adjusted trial balance, income statement, and the balance sheet.

- Its use as an organizational skill is underlined by how it summarizes all the necessary ledger balances in one value instead of a single account balance.

- The income summary account then transfers the net balance of all the temporary accounts to retained earnings, which is a permanent account on the balance sheet.

- So for example a debit entry to an asset account will increase the asset balance, and a credit entry to a liability account will increase the liability.

- As noted earlier, expenses are almost always debited, so we debit Wages Expense, increasing its account balance.

- Next you will take all of the figures in the adjusted trial balance columns and carry them over to either the income statement columns or the balance sheet columns.

When we sum the account balances we find that the debits equal the credits, ensuring that we have accounted for them correctly. Whether you’re posting entries manually or using accounting software, all revenue and expenses for each accounting period are stored in temporary accounts such as revenue and expenses. Once a company determines whether it has sustained a loss or earned a profit, the results from the final account are typically transferred into retained earnings on the balance sheet.

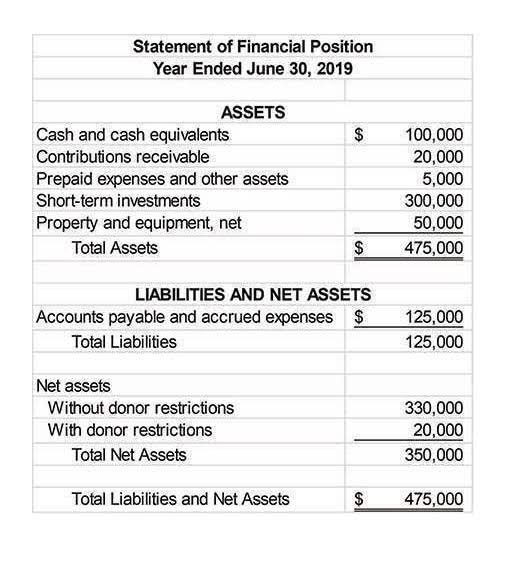

Balance Sheet

Information presented below walks through specific accounting terminology, debit and credit, as well as what are considered normal balances for IU. Since we credited income summary in Step 1 for $5,300 and debited income summary for $5,050 in Step 2, the balance in the income summary account is now a credit of $250. To get the numbers in these columns, you take the number in the trial balance column and add or subtract any number found in the adjustment column. There is no adjustment in the adjustment columns, so the Cash balance from the unadjusted balance column is transferred over to the adjusted trial balance columns at $24,800. Interest Receivable did not exist in the trial balance information, so the balance in the adjustment column of $140 is transferred over to the adjusted trial balance column. An income statement shows the organization’s financial performance for a given period of time.

- Expenses normally have debit balances that are increased with a debit entry.

- The statement of retained earnings always leads with beginning retained earnings.

- To complete the income summary account, the last step to preparing it must be one column for credit and another for debit.

- Harold Averkamp (CPA, MBA) has worked as a university accounting instructor, accountant, and consultant for more than 25 years.

- If your business is a sole proprietorship or a partnership, your next step will be to close your income summary account.

The normal balance is defined as the balance which would show either credit or debt when all the data from the journal is extracted. The normal balance is calculated by the accounting equation, which says that the assets of a company are equal to the sum of liabilities and shareholder’s equity. For accounts payable, the usual trend for the normal balance is usually credit. The company can make the income summary journal entry by debiting the income summary account and crediting the retained earnings if the company makes a net income. A contra account contains a normal balance that is the reverse of the normal balance for that class of account.

Free Debits and Credits Cheat Sheet

In many cases, the computer never even shows the income summary or has a record. Chartered accountant Michael Brown is the founder and CEO of Double Entry Bookkeeping. He has worked as an accountant and consultant for more than 25 years and has built financial models for all types of industries.

This process resets both the income and expense accounts to zero, preparing them for the next accounting period. In Completing the Accounting Cycle, we continue our discussion of the accounting cycle, completing the last steps of journalizing and posting closing entries and preparing a post-closing trial balance. The balance sheet is classifying the accounts by type of accounts, assets and contra assets, liabilities, and equity. Even though they https://www.bookstime.com/ are the same numbers in the accounts, the totals on the worksheet and the totals on the balance sheet will be different because of the different presentation methods. Looking at the asset section of the balance sheet, Accumulated Depreciation–Equipment is included as a contra asset account to equipment. The accumulated depreciation ($75) is taken away from the original cost of the equipment ($3,500) to show the book value of equipment ($3,425).